Abstract

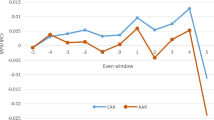

This paper contributes to the understanding of the relation between the environmental and social positioning of companies and the financial resilience in the specific context of the COVID-19 crisis. Resilience is measured through two dimensions based on stock price data: the severity of loss which captures the stability and the duration of recovery which captures the flexibility dimension. Using a sample of 1508 US based firms, we provide evidence that firms with high environmental and social (ES) rating were more resilient than low ES rating firms during the COVID-19 pandemic by lessening the severity of price drop and recovering faster. This effect is enhanced by using a non-linear approach based on quantiles. Further, we provide evidence that the effect of ES on resilience is focused on the environmental and social components. Interestingly, we show that management and shareholders sub-categories of the governance rating, have no impact on firm’s time to recovery during pandemic crisis.

Similar content being viewed by others

Notes

Source: COVID-19: Implications for business in 2020; December 16, 2020.

Blackrock, the largest active investor in the world reported better risk-adjusted performance across sustainable investment products for the first quarter of 2020 (Blackrock 2020). Morningstar claimed that 24 of 26 ESG-tilted index funds outperformed their closest conventional counterparts (Hale; 2020). MSCI boasted that all four of their ESG-oriented indices outperformed a broad market counterpart index (Nagy and Giese 2020).

Refinitiv also provides the ESG combined score which is an evaluation of a company’s ESG performance based on the reported information in the ESG pillars, with ESG controversies overlay captured from global media sources. Since we can not disentangle the ESG combined score into pillars, we settle for replicating our analysis with the ESG combined and find simlar results (Results are available on the supplementary materials).

One month later, prices declined by almost 30%.

In Sect. 4.3.3, we replicate our analysis using extended windows to the first and second quarter of 2021 and found similar results.

In Sect. 4.3.2, we replicate our analyses using ES measured at year-end 2018, 2020 and 2021. Most of our findings continue to hold.

We dropped 787 stocks for which prices are missing to compute resilience measure. The ES scores of 150 stocks were also unavailable, which deepened the sample size reduction. We also excluded stocks for which the control variables were unavailable. Table 12 provides all details of the sample construction.

Refinitiv classifies firms according to the ESG scores. A score above 0.5 indicates good ESG performance and above average degree of transparency in reporting ESG data publicly.

In all our regressions, we implement the Variance Inflation Factor test (VIF) for the mutlicolinearity issue. Our results show that all variables overcome the multicolinearity concerns which would not affect the regression results.

We thank the referees for highliting the importance that instruments should not be related to size effect.

In Refinitiv Datastream, Policy Board Independence variable answers the question whether the company have a policy regarding the independence of its board by taking into accounttwo dimensions: (1) the company strives to maintain a well-balanced board through an adequate number of independent board members and (2) independent board members maintain integrity and independence in decision making.

The Cox model is semi-parametric while Exponential, Weibull and Gompertz are parametric.

References

Adams M, Hardwick P (1998) An analysis of corporate donations: United Kingdom evidence. J Manag Stud 35:641–654

Albuquerque R, Koskinen Y, Yang S, Zhang C (2019) Corporate social responsibility and firm risk: theory and empirical evidence. Manag Sci 65:4451–4469

Albuquerque R, Koskinen Y, Yang S, Zhang C (2020) Resiliency of environmental and social stocks: an analysis of the exogenous COVID-19 market crash. Rev Corp Finance Stud 9:593–621

Almeida H, Campello M, Laranjeira B, Weisbenner S (2012) Corporate debtmaturity and the real effects of the 2007 credit crisis. Crit Finance Rev 1:3–58

Ambrosius C (2017) What explains the speed of recovery from banking crises? J Int Money Finance 70:257–287

Arjaliès D-L (2010) A social movement perspective on finance: how socially responsible investment mattered. J Bus Ethics 92:57–78

Attig N, El Ghoul S, Guedhami O, Suh J (2013) Corporate social responsibility and credit ratings. J Bus Ethics 117:679–694

Auer BR, Schuhmacher F (2016) Do socially (ir) responsible investments pay? New evidence from international ESG data. Q Rev Econ Finance 59:51–62

Bagnoli M, Watts SG (2004) Selling to socially responsible consumers: competition and the private provision of public goods. J Econ Manag Strategy 12(3):419–445

Balla-Elliott D, Cullen ZB, Glaeser EL, Luca M, Stanton CT (2020) Business reopening decisions and demand forecasts during the COVID-19 pandemic (No. w27362). National Bureau of Economic Research

Bansal P, Clelland I (2004) Talking trash: legitimacy, impression management, and unsystematic risk in the context of the natural environment. Acad Manag J 47:93–103

Bansal P, Jiang GF, Jung J, C., (2015) Managing responsibly in tough economic times: strategic and tactical CSR during the 2008–2009 global recession. Long Range Plan 48:69–79

Blackrock (2020) Sustainable investing: resilience amid uncertainty. https://www.blackrock.com/corporate/about-us/sustainability-resilience-research

Bouslah K, Kryzanowski L, Bouchra M (2018) Social performance and firm risk: impact of the financial crisis. J Bus Ethics 149:643–669

Carmeli A, Tishler A (2004) The relationships between intangible organizational elements and organizational performance. Strateg Manag J 25(13):1257–1278

Carpenter MA (2002) The implications of strategy and social context for the relationship between top management team heterogeneity and firm performance. Strateg Manag J 23:275–284

Cerqueti R, Ciciretti R, Dalò A, Nicolosi M (2021) ESG investing: a chance to reduce systemic risk. J Finance Stab 54:100887

Cheema-Fox A, LaPerla BR, Serafeim G, Wang H (2020) Corporate resilience and response during COVID-19. Harvard Business School working paper 20-1

Cohen G (2023) The impact of ESG risks on corporate value. Rev Quant Finance Acc 25:1–18

Cornett MM, Erhemjamts O, Tehranian H (2016) Greed or good deeds: an examination of the relation between corporate social responsibility and the financial performance of U.S. commercial banks around the financial crisis. J Bank Finance 70 C:137–159

Cox DR (1972) Models and life-tables regression. J R Stat Soc Ser B (methodol) 34:187–220

DesJardine M, Bansal P, Yang Y (2019) Bouncing back: building resilience through social and environmental practices in the context of the 2008 global financial crisis. J Manag 45:1434–1460

Díaz V, Ibrushi D, Zhao J (2021) Reconsidering systematic factors during the COVID-19 pandemic: the rising importance of ESG. Finance Res Lett 38:101870

Ding W, Levine R, Lin C, Xie W (2021) Corporate immunity to the COVID-19 pandemic. J Financial Econ 141(2):802–830

Duchin R, Ozbas O, Sensoy BA (2010) Costly external finance, corporate investment, and the subprime mortgage credit crisis. J Finance Econ 97:418–435

Dyck A, Lins KV, Roth L, Wagner H (2019) Do institutional investors drive corporate social responsibility? International evidence. J Finance Econ 131:693–714

Eccles RG, Ioannou I, Serafeim G (2014) The impact of corporate sustainability on organizational processes and performance. Manag Sci 60(11):2835–2857

El Ghoul S, Guedhami O, Kwok CC, Mishra DR (2011) Does corporate social responsibility affect the cost of capital? J Bank Finance 35(9):2388–2406

Fandella P, Sergi BS, Sironi E (2023) Corporate social responsibility performance and the cost of capital in BRICS countries. The problem of selectivity using environmental, social and governance scores. Corporate Social Responsibility and Environmental Management

Ferrell A, Liang H, Renneboog L (2016) Socially responsible firms. J Finance Econ 122:585–606

Ferriani F, Natoli F (2020) ESG risks in times of COVID-19. Appl Econ Lett 28:1537–1541

Ferrier WJ (2001) Navigating the competitive landscape: The drivers and consequences of competitive aggressiveness. Acad Manag J 44:858–877

Galbreath J (2013) ESG in focus: the Australian evidence. J Bus Ethics 118:529–541

Gantchev N, Giannetti M, Li R (2022) Does money talk? Divestitures and corporate environmental and social policies. Rev Finance 26:1–40

Garcia-Castro R, Arino MA, Canela MA (2010) Does social performance really lead to financial performance? Accounting for endogeneity. J Bus Ethics 92:107–126

Giese G, Lee LE, Melas D, Nagy Z, Nishikawa L (2019) Performance and risk analysis of index-based ESG portfolios. J Index Invest 9(4):46–57

Godfrey PC (2005) The relationship between corporate philanthropy and shareholder wealth: a risk management perspective. Acad Manag Rev 30(4):777–798

Godfrey PC, Merrill CB, Hansen JM (2009) The relationship between corporate social responsibility and shareholder value: an empirical test of the risk management hypothesis. Strateg Manag J 30(4):425–445

Hale J (2020) Sustainable funds weather the first quarter better than conventional funds. Morningstar Sustainability Matters

Harford J, Klasa S, Maxwell WF (2014) Refinancing risk and cash holdings. J Finance 69:975–1012

Harjoto M, Laksmana I (2018) The impact of corporate social responsibility on risk taking and firm value. J Bus Ethics 151:353–373

Hasford J, Farmer A (2016) Responsible you, despicable me: contrasting competitor inferences from socially responsible behavior. J Bus Res 69(3):1234–1241

Heinkel R, Kraus A, Zechner J (2001) The effect of green investment on corporate behavior. J Financ Quant Anal 36(4):431–449

Hoepner AGF, Oikonomou I, Sautner Z, Starks LT, Zhou X (2019) ESG shareholder engagement and downside risk. Working paper, September 2019. https://ssrn.com/abstract=2874252

Ilhan E, Sautner Z, Vilkov G (2019) Carbon tail risk. Working paper. https://ssrn.com/abstract=3204420

Indahl R, Jacobsen HG (2019) Private equity 4.0: using ESG to create more value with less risk. J Appl Corp Finance 31(2):34–41

Jawadi F, Louhichi W, Cheffou AI, Ameur HB (2019) Modeling time-varying beta in a sustainable stock market with a three-regime threshold GARCH model. Ann Oper Res 281:275–295

Lins KV, Volpin P, Wagner HF (2013) Does family control matter? International evidence from the 2008–2009 financial crisis. Rev Financ Stud 26(10):2583–2619

Lins KV, Servaes H, Tamayo A (2017a) Social capital, trust, and firm performance: the value of corporate social responsibility during the financial crisis. J Finance 4:1785–1824

Marsat S, Pijourlet G, Ullah M (2020) Is there a trade-off between environmental performance and financial resilience? International evidence from the subprime crisis? Account Finance 61:4061–4084

McKinsey and Company (2020) Social responsibility report 2020 delivering on our purpose. https://www.mckinsey.com/~/media/mckinsey/about%20us/social%20responsibility/2020%20social%20responsibility%20report/mckinsey-social-responsibility-report-2020.pdf

McWilliams A, Siegel D (2001) Corporate social responsibility: a theory of the firm perspective. Acad Manag Rev 26:117–127

Monti A, Pattitoni P, Petracci B, Randl O (2022) Does corporate social responsibility impact equity risk? International evidence. Rev Quant Finance Acc 59(3):825–855

Nagy Z, Giese G (2020) MSCI ESG indexes during the coronavirus crisis. https://www.msci.com/www/blog-posts/msci-esg-indexes-during-the/01781235361

Navarro P (1988) Why do corporations give to charity? J Bus 61(1):65–93

Nguyen T, Nguyen HG, Yin X (2015) Corporate governance and corporate financing and investment during the 2007–2008 financial crisis. Financ Manag 44(1):115–146

Nollet J, Filis G, Mitrokostas E (2016) Corporate social responsibility and financial performance: a non-linear and disaggregated approach. Econ Model 52:400–407

Ortas E, Moneva JM, Burritt R, Tingey-Holyoak J (2014) Does sustainability investment provide adaptive resilience to ethical investors? Evidence from Spain. J Bus Ethics 124:297–309

Paunov C (2012) The global crisis and firms’ investments in innovation. Res Policy 41:24–35

Pisani F, Russo G (2021) Sustainable finance and COVID-19: the reaction of ESG funds to the 2020 crisis. Sustainability 13(23):13253

Porter M, van der Linde C (1995) Toward a new conception of the environment competitiveness relationship. J Econ Perspect 9:97–118

Reinhart CM, Rogoff KS (2014) Recovery from financial crises: evidence from episodes. Am Econ Rev 104:50–55

Renneboog L, Ter Horst J, Zhang C (2011) Is ethical money financially smart? Nonfinancial attributes and money flows of socially responsible investment funds. J Financ Intermed 20:562–588

Revelli C (2017) Socially responsible investing (SRI): from mainstream to margin? Res Int Bus Finance 39:711–717

Shan C, Tang DY (2022) The value of employee satisfaction in disastrous times: evidence from COVID-19. Rev Finance 2022:rfac055

Shea J (1997) Instrument relevance in multivariate linear models: a simple measure. Rev Econ Stat 79:348–352

Siegel SD, Vitaliano DF (2007) An empirical analysis of the strategic use of corporate social responsibility. J Econ Manag Strategy 16(3):773–792

Suchman R (1995) Managing legitimacy: strategic and institutional approaches. Acad Manag Rev 20:571–610

Price water house Coopers (PwC) (2014) Sustainability goes mainstream: insights into investor views. Investor Survey. http://www.pwc.com/us/en/pwc-investor-resource-institute/index.jhtml

Tarmuji I, Maelah R, Tarmuji NH (2016) The impact of environmental, social and governance practices (ESG) on economic performance: evidence from ESG score. Int J Trade Econ Finance 7(3):67

Udayasankar K (2008) Corporate social responsibility and firm size. J Bus Ethics 83:167–175

Willis A (2020) ESG as an equity vaccine. Morningstar market insights. https://www.morningstar.ca/ca/news/201741/esg-as-an-equity-vaccine.aspx

Zhao C, Guo Y, Yuan J, Wu M, Li D, Zhou Y, Kang J (2018) ESG and corporate financial performance: empirical evidence from China’s listed power generation companies. Sustainability 10(8):2607

Acknowledgements

We are very grateful to participants at the 2022 Financial Economic Meeting, 2023 Conference on Financial Markets and Corporate Governance in Australia, 2023 Association Française en Finance Conference in Bordeaux, 2023 Financial Management Association in Denmark, 2023 European Financial Management Conference in United Kingdom and seminar series at the University of Lille and Bucharest University for useful comments and suggestions.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Electronic supplementary material

Below is the link to the electronic supplementary material.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Ameur, H.B., Boussetta, S. Do environmental and social practices matter for the financial resilience of companies? Evidence from US firms during the COVID-19 pandemic. Rev Quant Finan Acc (2023). https://doi.org/10.1007/s11156-023-01218-4

Accepted:

Published:

DOI: https://doi.org/10.1007/s11156-023-01218-4